I’m looking for a calendar solution that does all of this well: Personal Calendars, Staff Calendar, Public Facing Calendar. One service, one app. Any suggestions?

I’m addicted to milkshakes. Have been since I was a kid. I’m sure part of it is related to good memories, but there is not much bad in life that a good milkshake can’t cure.

I came home to Lego day apparently. My son is doing a new House Lego, my daughter is doing a Sonic one, and my wife is working on a Kingfisher. Also in the photo is a Lego chess board.

Finished reading: Masters of the Air MTI by Donald L. Miller 📚

I wanted to read this after watching Masters of the Air, and I enjoyed it immensely. It does get into bomber warfare philosophy/morality, but manages to do it with an even hand. I would’ve loved to meet those incredible men and women.

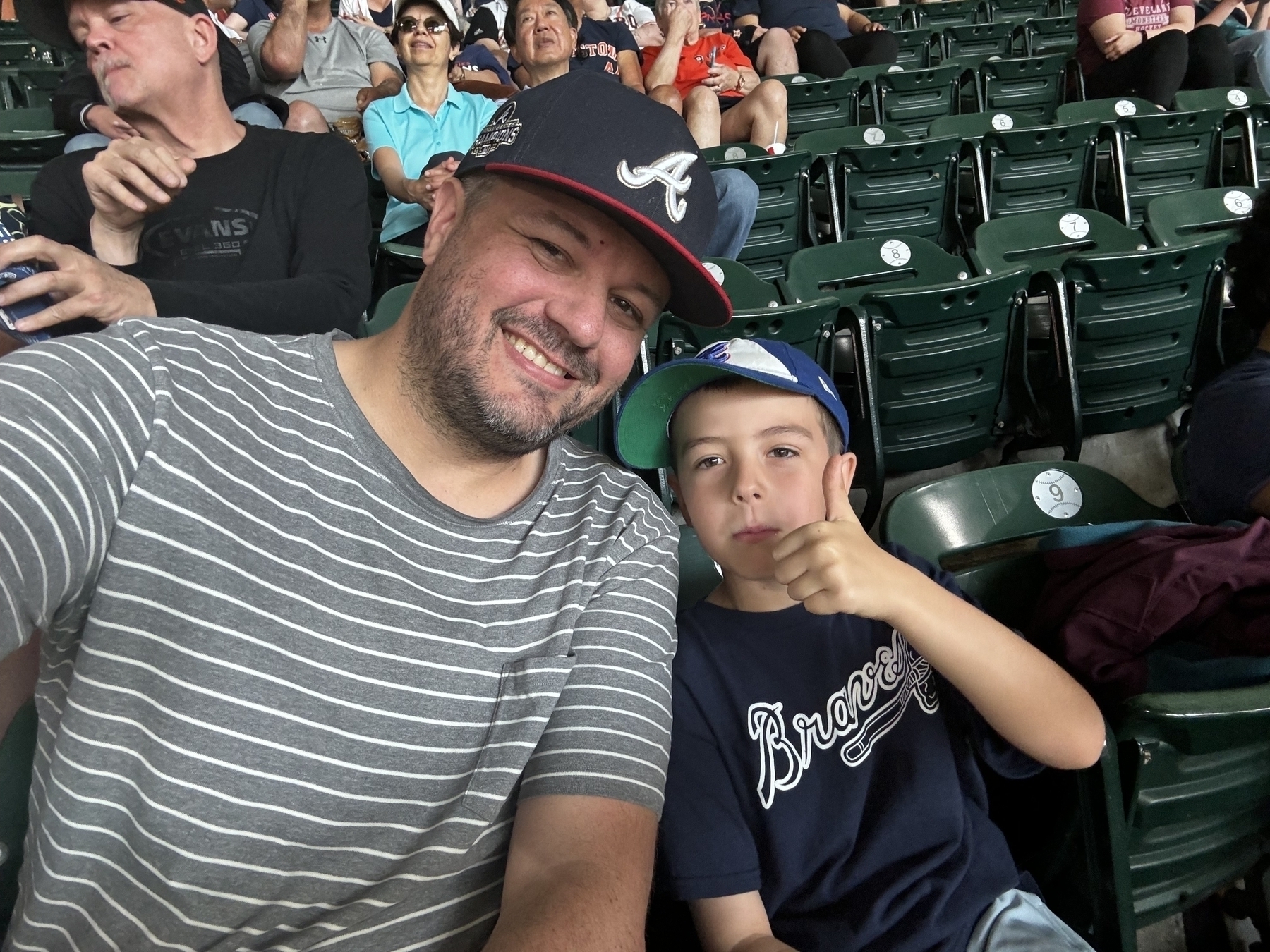

Getting back into the swing of things after a family vacation to catch some Braves games. I always have a little trouble focusing for the first day or two after a trip. Maybe that means all vacations should be longer?

Took a few vacation days with the family to catch the Braves for 3 in Houston. All wins!

Tiny Theme 2.7.7 now has broader support for things like asides, alerts, and notes within your content. See examples. It also includes CSS variable support for them to allow easy customization.

I’ll give a nickel to anyone who can find me an in-stock Fujifilm X100V or X100VI without the insane markup.

Good things from @lmika for those of you who would like a sidebar for the blogroll in Tiny Theme.

Release version 1.1.1 of Sidebar for Tiny Theme. You’ll need to upgrade Tiny Theme to version 2.7.4 or later to use it, but the good news is that it’s no longer replacing any templates of Tiny Theme itself. It’s all now working with hooks, which is a much nicer way of doing things.

It’s a couple generations old, but I grabbed a lightly used Fujifilm X100F. As a beginner-ish, it’s such an appealing camera. I’m still learning my way around it and playing with settings/recipes, but I can definitely see myself using it often.

I’ve enjoyed using Kagi for search, but it’s not quite worth the subscription price for me yet. I found myself needing other search engines just enough for it to be annoying. I’m sure it’ll improve over time and I look forward to giving it another chance in the future.

Has anyone created any cool CarPlay shortcuts?

It’s Opening Day!

This baby girl is 5 today. Happened way too fast.

Tiny Theme 2.7: Fundamental Changes to 'More' Tag Usage

Tiny Theme has been updated to version 2.7 and includes a fundamental change to how posts can be truncated with a Read More tag. Previously, you needed to use a Summary Posts plugin (now archived). The feature is now built-in for all users. Simply add a more tag within your post and it’ll be properly truncated on your main blog page.

That’s hardly breaking news, but here is where things change. Hugo (and thus Micro.blog) has limited support for formatting and handling this style of truncated posts/summaries. Typically, all HTML formatting (links, photos, etc) would be stripped out when using that tag. Obviously, that’s not ideal. Tiny Theme will now handle that how you might expect. Your blog feed, even when using the More tag, will show all HTML as intended on the post feed even when you use more tags.

What’s a famous movie filmed (or set) in your hometown? For me, it’s Secretariat and The Apostle. 🍿

My Top 5 Flashlights to Carry

For years, I’ve been in what many call the EDC Community. Basically, that means I’m more cognizant of what I carry on a daily basis. Technically speaking, everyone has an EDC (or Every Day Carry). For most people, that includes a phone, keys, and wallet. Others take it a step further with a pocket knife or leaps and bounds further with a fully stocked sling/bag.

One of the most common extra items is a flashlight. If you’re questioning the necessity of carrying a flashlight by asking, “Why not use the flashlight on your phone?” then you likely aren’t the individual who needs to carry a flashlight. But if you find yourself needing a legitimate standalone flashlight often (perhaps due to your job) or just want to see what it’s like to carry one, this list is for you.

Dads that carry a satchel or small sling, what do you keep in yours?

Looks like @lmika snuck in a new plugin specifically for Tiny Theme to add a sidebar with your blogrolls. Awesome job!

The festivals are starting!